Betting on sports can be thrilling, but it’s also risky. For those who want to minimize losses or secure profits, a hedging calculator can be a game-changer. While some bettors are familiar with hedging in financial markets, it works similarly in sports betting. Whether you’re betting on the NBA playoffs, March Madness, or a high-stakes boxing match, a hedging calculator can help ensure you come out ahead, regardless of the outcome.

What is a Hedging Calculator?

In sports betting, a hedging calculator is a tool that helps you adjust your bets as the game or season progresses, locking in profits or limiting losses. For example, if you place an early bet on a long-shot team to win the NBA Finals, you could later use a hedging calculator to place counter-bets that protect your original investment.

Why Use a Hedging Calculator in Sports Betting?

Many sports bettors use hedging as a way to manage risk. With a hedging calculator, you can adjust your bets as circumstances change, whether due to a team injury, an unexpected score, or even shifting odds. By using this calculator, you can:

- Lock in Profits: Secure a guaranteed win regardless of the final score.

- Minimize Losses: Reduce the financial impact of a losing bet.

- Stay Flexible: React to real-time changes in games or seasons.

Practical Example: Hedging Calculator in Action

Imagine you placed a bet on the Kansas City Chiefs to win the Super Bowl with odds of +800. As the season progresses and they make it to the Super Bowl, you might want to guarantee a profit by betting on their opponent. Here’s how you’d use a hedging calculator to make that decision:

- Initial Bet: $100 on Chiefs at +800 (potential payout: $900).

- Calculate Hedge Bet: Using the calculator, you’ll find out how much to bet on the opposing team.

- Results: Place the hedge bet and secure a win regardless of the Super Bowl outcome.

Popular Sports and Events Where Hedging Works

Certain sports and events provide better hedging opportunities due to their competitive structures or popularity. Here’s a look at some common scenarios:

- March Madness: With its single-elimination format, March Madness is perfect for hedging bets, especially as the tournament progresses.

- Super Bowl: Futures bets on the Super Bowl allow for excellent hedging opportunities.

- NBA Finals: NBA fans who place early-season bets on potential champions often hedge as teams make it to the Finals.

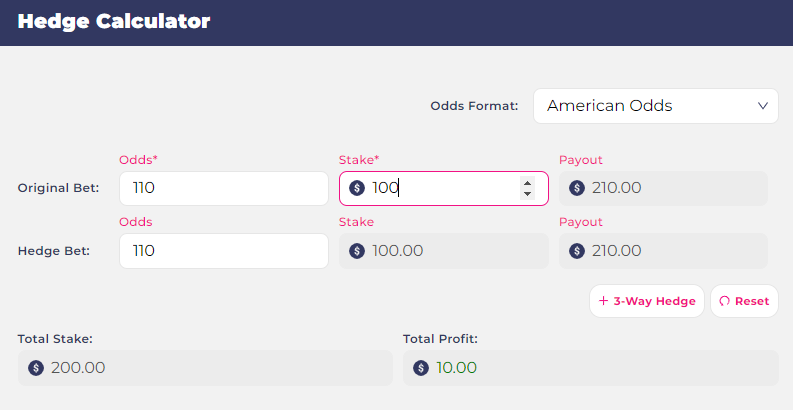

Types of Hedging in Sports Betting

Full Hedge

A full hedge means betting an amount that ensures a profit regardless of the outcome. This is commonly done when you’ve made a high-risk bet with good odds and want to secure a profit as you get closer to the game day.

Partial Hedge

With partial hedging, you place a smaller amount on the opposite outcome, securing some profit but still having a higher win if your original bet hits. This is a good option if you’re confident in your bet but want a safety net.

Live Betting Hedge

Live betting is increasingly popular as it allows you to hedge during the game. For instance, if one team takes an early lead, you can use live betting odds to place a hedge bet on the opposing team, capitalizing on real-time events.

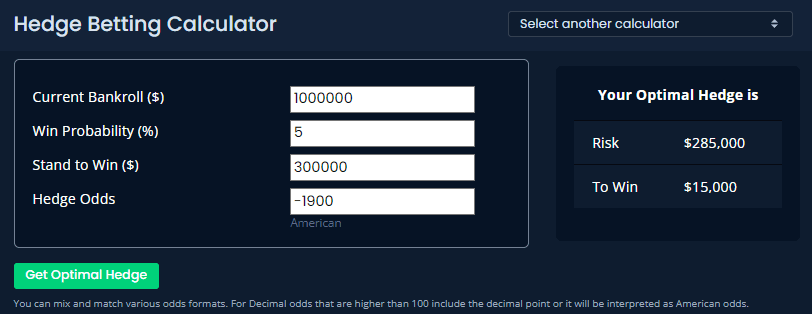

How to Calculate a Hedge Bet Manually

Although a hedging calculator is convenient, you can also calculate a hedge manually. Here’s a simple formula:

- Determine the Potential Payout of the Original Bet (including the initial stake).

- Divide the Potential Payout by the Odds of the Opposite Outcome.

For example, if your original bet on Team A has a payout of $900 and the opposing team’s odds are -110, you’d divide $900 by 1.91 (decimal version of -110 odds), resulting in a hedge bet amount around $471.

Top Athletes and Teams for Hedging Bets

- NFL: Teams like the Kansas City Chiefs and the Philadelphia Eagles are common hedge opportunities.

- NBA: The Los Angeles Lakers and Milwaukee Bucks are good hedge bets.

- MMA: Fighters like Conor McGregor and Israel Adesanya attract lots of action, making their fights hedge-worthy.

Tips for Effective Hedging in Sports Betting

Using a hedging calculator is just one aspect of successful hedging; understanding when and how to hedge effectively can make a huge difference. Here are a few tips:

- Watch the Timing: Timing is everything in hedging. Ideally, hedge your bets when the odds are most favorable, which might be right before the game or during live betting when momentum shifts.

- Analyze Game Factors: Look at key elements like player injuries, recent performance, and venue. For instance, if you bet on an underdog, you might want to hedge if their star player is injured, as this could affect the team’s performance.

- Stay Informed About Odds: Make it a habit to follow odds from multiple sportsbooks. You may find better hedging opportunities if different platforms have varying odds on the same game.

When Not to Hedge a Bet

Hedging isn’t always the best choice. Knowing when not to hedge can sometimes save you from reducing potential winnings. Here are situations where it might be better to let your initial bet ride:

- Small Initial Bet: If your original bet was small, the potential gains from hedging may not be significant enough to justify the effort.

- Strong Initial Odds: If you have favorable odds that are unlikely to change significantly, hedging might not improve your position.

- Confident in the Outcome: If you believe that the original team or player is almost certain to win and there haven’t been unexpected changes, you might choose not to hedge.

Calculating Hedging Percentages for Partial Hedging

One of the more complex parts of hedging is determining the percentage you want to hedge. Partial hedging, where you don’t cover the entire bet, can allow for some profit potential while still reducing risk. For example:

- 50% Hedge: Cover half of your original bet, allowing you to secure some profit if the outcome goes against you but maintain higher winnings if your original bet is correct.

- 75% Hedge: This approach gives a more conservative profit guarantee, ideal for bettors who prioritize minimizing losses over maximizing profit.

A partial hedge calculator would allow you to set these percentages, giving you flexibility on how much risk you want to take.

Using Hedging with Parlay Bets

Parlay bets, which involve betting on multiple events for a single payout, are riskier but more profitable when successful. Here’s how a hedging calculator can help with parlay bets:

- After Winning Initial Legs: If you’ve won the first few legs of a parlay, you can hedge by betting on the opposite side of the remaining games. This allows you to lock in some profit no matter how the rest of the parlay unfolds.

- High-Risk Parlay Scenarios: Because parlays offer such high potential returns, it might be worth using a partial hedge. For instance, if you have a 5-game parlay and have won the first four, a hedge on the last game ensures you don’t walk away with nothing if the final game doesn’t go your way.

The Role of Bankroll Management in Hedging

Good bankroll management is essential in sports betting, and this is especially true when you’re hedging. Setting aside a specific portion of your bankroll for hedging can prevent you from overspending:

- Use a Fixed Hedge Budget: Set a limit on how much you’re willing to spend on hedging per game or week.

- Reevaluate Your Hedge Strategy: As your bankroll fluctuates, it may be necessary to adjust your hedging amounts. For instance, if you experience a losing streak, consider reducing hedge bets until you regain consistency.

- Keep Hedging Separate: Track your hedging bets separately from other bets to see how much you’re profiting or losing from this strategy.

Potential Risks of Over-Hedging

Over-hedging is a common pitfall, where bettors place so many hedges that they reduce or even eliminate their original profit potential. Here’s why this is risky:

- Diluted Profits: Each hedge you add cuts into your potential profit margin. Too many hedges and your winnings become negligible, essentially reducing betting to break even.

- Higher Costs: Every hedge requires a new bet, and if you’re betting on multiple outcomes in complex games like multi-team parlays, the costs can add up quickly.

- Unnecessary Complexity: Hedge too much, and your betting strategy may become overly complicated, making it hard to track and evaluate.

Understanding these risks can help you avoid the trap of over-hedging and ensure that your hedging strategy remains profitable.

Using Hedging for Long-Term Futures Bets

Futures bets, such as betting on a team to win the NBA Championship before the season starts, can offer high returns if you choose the right underdog. However, as the season progresses, you might want to hedge if the odds become less favorable. Here’s how a hedging calculator can help:

- Seasonal Progression: As the season unfolds, keep track of changes in odds. Teams may experience injuries or unexpected losses that affect their championship chances.

- Early Wins: If your future bet team performs well early in the season, consider hedging against them if they’re facing tough opponents later in the playoffs.

- Hedge in Playoffs: Once your team reaches the playoffs, placing hedge bets on their opponents could allow you to lock in some profits regardless of who ultimately wins.

Combining Hedging with Other Betting Strategies

Hedging can be used in conjunction with other betting strategies for more refined risk management:

- Arbitrage Betting: This is when you place bets on all possible outcomes at different sportsbooks to guarantee a profit. By using hedging along with arbitrage, you could improve your profit margins even further.

- Martingale System: Typically used for even-odds bets, the Martingale system doubles the stake after each loss. When combined with hedging, you can minimize losses but still keep the potential for recovery.

- Kelly Criterion: This mathematical formula helps determine the optimal bet size. Applying a hedge based on the Kelly Criterion can balance between the potential for growth and risk.

Factors to Consider Before Using a Hedge Calculator

Before you dive into hedging bets, think about these important factors:

- Odds Fluctuation: Odds change frequently, and hedging might require you to act fast. If you wait too long, you may miss an optimal opportunity.

- Expected Value (EV): Not all bets are worth hedging. Calculate the expected value to see if your potential gains are high enough to justify the hedge.

- Fees and Commissions: Some sportsbooks charge fees on both initial and hedge bets. Factor these costs into your calculations to ensure the hedge remains profitable.

Each of these considerations can help you refine your hedging strategy, making it a more effective tool for managing your sports betting.

Limitations of a Hedging Calculator

While a hedging calculator is helpful, it’s important to remember that there are some limitations:

- Odds Fluctuations: Live betting odds can change quickly, so calculations may not always be accurate in real time.

- Sportsbook Fees: Some sportsbooks charge fees on bets, which can affect your actual profit.

- High-Risk Events: In highly volatile sports like MMA, even hedging might not eliminate all risks.

Is a Hedging Calculator Worth Using?

A hedging calculator is invaluable for sports fans who want to make their bets as risk-free as possible. By calculating the exact amounts needed to cover potential outcomes, this tool empowers bettors to make informed decisions. Whether you’re betting on the NFL, NBA, or UFC, a hedging calculator adds a strategic layer to the betting experience, ensuring that fans can enjoy the thrill of the game without all the financial risk.